Pine Labs IPO: The Power of Consistent Compounding

Shailendra Singh

Published November 14, 2025

An Unusual Seed Investment

March 2009 was a scary time, it was the worst month for public markets during the GFC. During that month, the team at Peak XV (then Sequoia Capital India) made a small $1.2M investment in Pine Labs, a Noida-based startup. It wasn’t a consensus investment, as the company wasn’t easy to understand and the payment ecosystem in India was in its infancy. The company had spun out of a high performing Sequoia India portfolio company called GlobalLogic (which eventually became a decacorn) and most of the cap table of GlobalLogic received shares in Pine Labs. GlobalLogic was doing so well at the time that most people did not spend time on the tiny, “non core” business.

The thesis that a retail payments business would become a scalable opportunity was unclear. Square and Stripe were not yet born so this wasn’t a hot category yet. Moreover, there was an interesting nuance in the Pine Labs model that remained misunderstood for years. The company had created a software infrastructure layer for merchants that allowed them to process payments on many merchant acquirers. This was not a PoS company or even a merchant acquirer as the world always thought it to be; it was a cloud-based software infrastructure service for processing payments across multiple merchant acquirers. The PoS was simply the form factor at the front end which evolved over time. A software platform thesis eventually excited us to invest.

But there was another compelling reason to invest: a special founder. Lokvir Kapoor was a brilliant product thinker and builder, and relentlessly focused on building a superior customer proposition. He hated competing on price. He never followed fads. He relentlessly demonstrated first principles thinking.

Finding PMF

Our journey began slowly at first. The first 3-4 years the company mostly missed revenue goals and it took a lot longer to find product-market fit than we thought it would. After a few iterations, the company started to have a strong proposition for large retailers and our PoS software platform and cloud-based service made us, what we would call today, an N=1 company in India. All the other competitors were banks, or traditional merchant acquirers but they couldn’t do what Pine Labs did, something we later called “multi acquiring”. But the market size was still unclear.

The Peak XV team faced an interesting dilemma. We believed we had a unique company with super strong moats and a compelling customer proposition. But it wasn’t clear how long it would take to get to scale. Most shareholders in the cap table owned shares for more than 10 years (since the early days of GlobalLogic). Even though there were still many unanswered questions, it presented a unique opportunity for us to double down. Actually, to triple down. Over a few rounds of primary and secondary investments, funds managed by Peak XV and their affiliates bought a bit over 72% ownership in the company.

Obviously, this was highly unusual and the team would make fun of me for having championed this investment. One of the senior Sequoia leaders once famously told me, “you can’t buy more than 100% of the company, no matter how much you love it :)”. I always joked back on the unusual cap table by saying we had three good series A investments in one.

Steady Compounding During Years of Uncertainty

Even after having a strong product-market-fit in organized retail, the journey was a roller coaster. A lot changed in payments in India in the years ahead. At one point, imitators of Square (now called Block Inc) started launching cheap dongles to process payments. The venture industry generously funded them. Lokvir believed these startups had an inferior customer proposition and would suffer from bad unit economics and he never ventured to compete with these low cost competitors. His conviction proved correct several years later. Then UPI arrived and the death of PoS was proclaimed by all and sundry. Pine Labs evolved their model to have dynamic QR, a safer version of QR on the PoS platform, and eventually became a key player in UPI.

Over time, the company kept compounding and adding products. They listened carefully to customers and focused on sensible execution. The team focused on organically and inorganically building multiple businesses that kept compounding.

Leadership Transition

As the company grew, and became larger and more successful, Lokvir decided to step aside to focus on his family and personal priorities. He asked me to help find a new CEO that could lead the company to the next level. I turned to a long-time friend, Vicky Bindra, who was a terrific leader but his stint was shortened by his family’s need to be in the US. So we were back to looking for a new leader and I wanted to get someone who would act like a founder, not just a CEO. Enter Amrish Rau.

Amrish was an ex-founder and ally for my partner Mohit and Peak XV had backed his prior startup, Citrus Payments. Amrish was looking to start up again but I convinced him to come and lead Pine Labs instead. In the first week of March 2020, when the world was on the edge of a once-in-a-century Covid outbreak, Amrish started as CEO of Pine Labs, only to find weeks later that all retail in India was shut down and payments volume was down to zero.

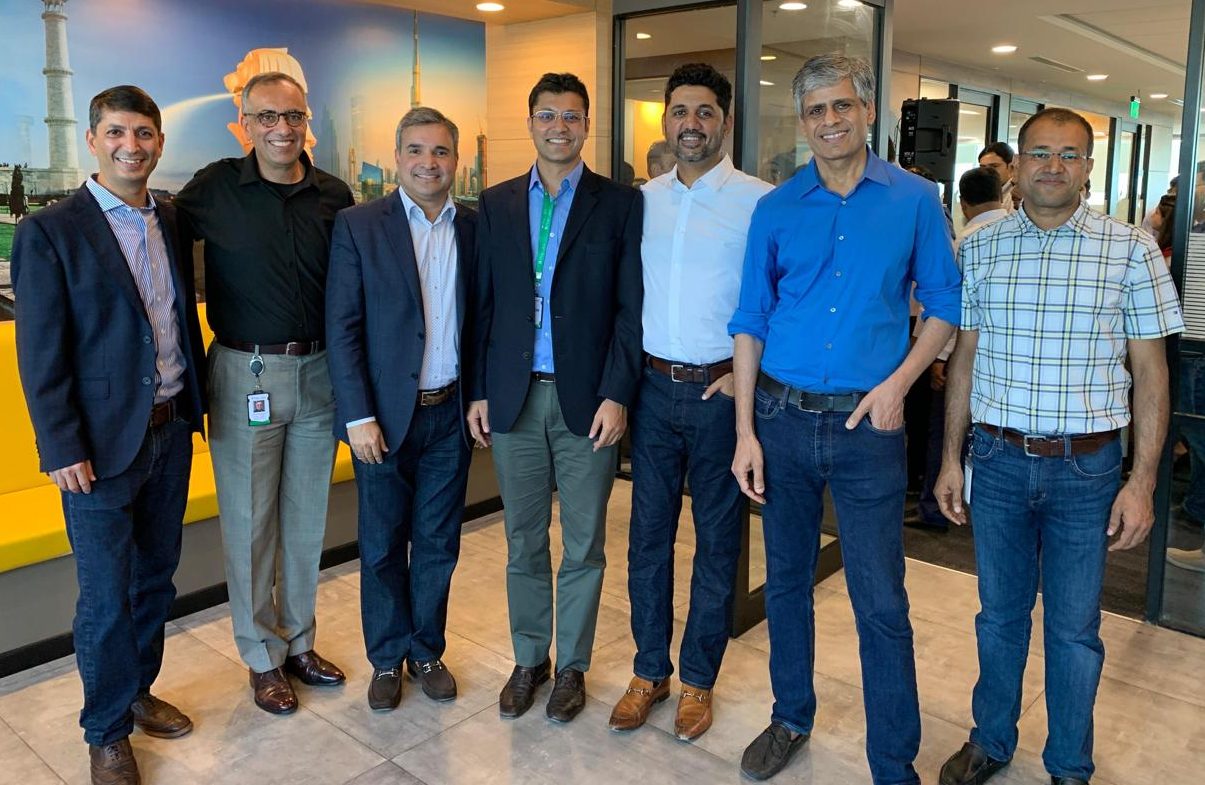

Amrish, a determined and energetic leader, showed the grit and resilience most founders would aspire for. Not only did Pine Labs go from strength to strength, he helped build several important businesses in Pine Labs over the next few years. Most importantly, he attracted numerous high caliber leaders to Pine Labs and evolved the culture and leadership in his own unique way.

Building a Multi-Product Payments Platform Company

During Amrish’s tenure, the company also attracted many world-class global investors who joined the cap table. A series of these financings allowed Peak XV to reduce its stake to ~20% and realize over $575M in gross cash proceeds1, a meaningful win for Peak XV’s early stage funds. Several other early shareholders, Lokvir, and management team members also achieved meaningful liquidity alongside. A key partner for Amrish during this phase, was Piyush Gupta, who led Sequoia India’s Strategic Development team for many years.

Under Amrish’s leadership, Pine Labs evolved to become a diversified payments platform business. Their Qwikcilver acquisition, which is a market leading product on the issuing side, proved to be a highly valuable business. He also led the acquisitions of Setu and Mosambee, which have both become strategically and financially highly accretive.

Today, Pine Labs has multiple lines of business, each of them a profitable compounding machine with strong software platform moats. The leaders of each of these companies, including Kumar Sudarsan, Sameer Chugh, and Nikhil Kumar and Sahil Kini have worked alongside the Pine Labs team, and contributed meaningfully to its success. I consider each of them a co-founder in our journey.

Day 01 as a Public Company

As Amrish and the leadership team ring the IPO bell, we couldn’t be more grateful to everyone who has contributed to the Pine Labs journey.

This is of course not the final destination; it’s just day 01 in the life of Pine Labs as a public company. The stakes are higher now, the burden of responsibility for having public shareholders is even greater. We wish the team much continued success in their journey as a public company and continue to believe that the compounding machine at Pine Labs will keep going.

A Vote of Thanks

This journey has seen invaluable contributions from so many individuals over the years. Immensely grateful to all the current and past leaders at Pine Labs, many current and former colleagues at Peak XV, board members and advisors, and co-investors who have been terrific partners for us.

1The figure of $575M represents gross cash proceeds realized by funds managed by Peak XV and its affiliates. This figure does not reflect the deduction of management fees, carried interest, taxes, and other expenses borne by investors, which would reduce the actual returns to investors. Returns on a “net” basis would be lower.

Disclaimer: This content is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities or interests in any fund managed by Peak XV Partners (“Peak XV”). Any such offer or solicitation will be made only by means of a confidential private placement memorandum and other offering documents. Past performance is not indicative of future results. The performance described herein refers to specific events and market conditions that may not be repeated. No representation is being made that any investor will or is likely to achieve profits or losses similar to those shown.