Indian fintech’s blue sky opportunity

The early years of a credit cycles is one of the best times to launch and build a financial services company. The post-COVID period will seperate great companies from the rest, and could annoint India’s fintech winners.

Ashish Agrawal

Published July 24, 2020

Last year, we outlined why we at Sequoia Capital India thought it was a great time for fintech entrepreneurs to build new businesses in India. Ubiquitous smartphone penetration, low-cost data, cheap payment rails and the rise of digital enablers like e-KYC were coming together to create a unique confluence of positive tailwinds. This trend resulted in many new attempts in fintech and the sector being amongst the top recipients of venture financing last year.

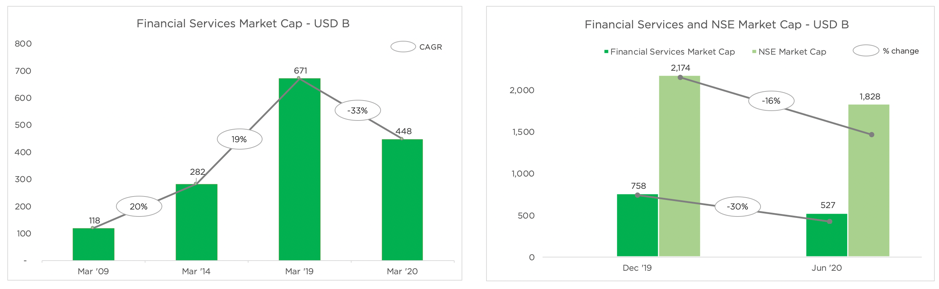

Since the outbreak of COVID-19 and the ensuing economic slowdown, doubts have appeared in many minds around the India fintech opportunity. This has been led by a stock market correction that has hit financial services companies particularly hard. The total market capitalization of India’s publicly traded financial services companies collapsed by a third between Mar-19 and Mar-20. This is pretty stark, considering the combined market cap of the sector had grown at a CAGR of 20% for the preceding 10 years. This correction is steeper than in other sectors of the economy, and as a result financial services’ share of the NSE market cap has declined from 35% at peak to < 30% by June end.

The sell-off has been driven by concerns over declining credit quality. Businesses suffering from the extended lockdown, and consumers hit by salary cuts and job losses, maybe unable to service their debts. This could result in significant delinquencies for lenders. Many lenders are also extending a 6-month moratorium to their borrowers under RBI’s guidelines — but are not always able to get that break from their lenders (larger banks, NCDs, MFs). This results in the additional complication of asset liability mismatch resulting in a cash crunch. Finally, the lockdown made it harder to carry out ongoing operations for financial services companies, which is impacting their ability to collect back loans, underwrite new insurance policies, etc.

While all these factors will certainly impact the operations of financial services businesses in the near term, the long-term prospects are far from bleak. On the contrary, we feel the current set of events may provide a stronger opportunity for fintech startups.

1. Think a decade ahead, not just one year from now

There is still a huge unmet need for financial services in emerging markets like India and demand will continue to compound. In fact, in some industries like health insurance and investment brokerage, recent events have accelerated growth. The brokerage industry, for instance, added over 2M new transacting investors in Q2 2020 — which is more than the number added in the preceding two years.

The last credit cycle, which lasted over a decade, is nearing an end and will give birth to a new credit cycle, that could run for the next decade. The early years of a credit cycle are amongst the most wonderful years to build a financial services business. Bajaj Finserv started as a demerged entity just before the start of the last credit cycle (’08–09) and Kotak Bank received its banking license at the beginning of the credit cycle before that (’03). Both Bajaj Finance and Kotak today have $25B+ market cap. Young fintech startups in India have the opportunity to be beneficiaries of the next credit cycle. While the next year may not look rosy to many, the next decade likely will.

2. Existing fissures getting wider

Expansionist strategies, characteristic of fair-weather times, are quickly reigned in after a downturn. Established institutions are being forced to retreat to their fortifications, leaving the outposts open for specialized new entrants. For instance, larger banks which were till date aggressive on expanding their consumer centric loan books have tightened their credit policies and are now disbursing to only the highest credit borrowers. This leaves an opportunity open for newer entrants to service the needs of much of the rest. Companies like Moneytap and Capitalfloat, which is powering Amazon’s pay later program, are stepping in to capture this opportunity with fully digital lending processes. In the gold loans segment, which has outperformed during the pandemic, Rupeek is becoming the platform of choice for banks and larger financial institutions to partner with to play in the segment.

3. Technology a stronger source of competitive advantage

The COVID-19 crisis has shown how companies with a stronger technology core are able to adjust and adapt more quickly than those who don’t. For instance, Leap Finance and Eduvanz, which give education loans, continued to leverage their digital lending stacks to sanction and disburse credit to good borrowers during lock-down while their traditional offline competitors froze. Similarly, wealth management platforms like Groww, Zerodha and Smallcase have continued to service investors during lock-down, where many traditional brokers with an offline-first model struggled. Financial companies with strong technology capabilities will come out ahead post this cycle.

The COVID-19 crisis is also accelerating the drive towards digitization across the financial services sector. Offline digital payments are getting a boost; services offered by companies like Bharatpe, Phonepe, Google Pay and PayTM that process payments without a physical touch get a further leg-up over cash. Digital banking is seeing strong tailwinds. Software businesses selling to financial institutions, from e-KYC and RPA solutions to digital loan collection platforms, are seeing an acceleration in sales. Companies providing such solutions are beneficiaries of the crisis.

4. Favorable regulatory tailwinds

The Indian fintech industry is a beneficiary of the buildout of digital public infrastructure — from UPI, which provided low cost payment rails, to Aadhaar-based KYC which reduced the cost of customer onboarding. The next set of government initiatives are equally exciting — Account Aggregators will enable easier information flow between financial entities with explicit user consent. The Open Credit Enablement Network, announced recently, will provide a common protocol for lenders further giving a boost to digital lending. These initiatives make India amongst the most fertile playgrounds for digital financial services.

Historically, regulation had also limited monetization potential of parts of financial services in India. For instance, players enabling UPI based digital payments were processing transactions at close to 0 MDR, having to monetize only from add-on services. The ecosystem is evolving towards a healthier MDR which will boost monetization potential of digital payments companies like Razorpay, Pine Labs and Bharatpe.

5. Expertise will separate the winners from the rest

Fintech is hard. In recent years, with abundant capital availability, building a financial services business appeared simple. Entrepreneurs are now discovering how hard it is for instance to run high quality lending operations. On the other hand, companies with strong foundations are surging ahead. Several lending companies such as Five Star, Finova and Aptus, for example, have managed over 90% collection in the recent month during lockdown, which is better than even major banks. The crisis will make it easier to discern great companies from the rest and could anoint the winners.

Bear in mind, the first order of business for fintech founders is to survive this crisis. In the short term, startups need to focus on conserving cash and sailing through the next few quarters. The ones which emerge on the other side will likely find a far more prosperous landscape than the one they left behind. At Sequoia, we think about long term value creation. Sequoia Capital India has partnered with over 30 fintech and financial services companies. We continue to be excited about the fintech opportunity in India. If you are a fintech entrepreneur looking to raise capital, do give us a shout.

Disclosure: Sequoia funds are shareholders in Moneytap, Capitalfloat, Rupeek, Leap Finance, Eduvanz, Groww, Smallcase, Bharatpe, Pine Labs, Razorpay, Five Star, Finova and Aptus.