Going Public: An IPO Checklist for Startups

A company typically starts thinking about going public when it starts getting visibility on three important qualifying conditions.

Piyush Gupta

Published December 18, 2020

Disclaimer: An IPO is a very specific and regulated product that can have nuances related to the company’s sector, its country of operations and which country it chooses to list in. This is a simplified version and you are welcome to contact the author for a deeper discussion. This is not meant to constitute legal, financial, tax or any other advice; and you should consult your advisors as required.

A company typically starts thinking about going public when it starts getting visibility on three important qualifying conditions:

- A clear market position in the space the company has chosen to serve.

- Financial maturity – adequate financial scale that gives stability to the overall company; profitability or visibility to profitability.

- Process maturity – Accounts are being closed accurately and fast at each quarter end; there is some predictability to the business, governance is being formalized, amongst others.

Once companies see these factors start to fall into place and decide to do an IPO, there’s still a ton of work to be done to pull it off successfully.

It can take one to two years to get ready. Here’s a summary of the steps founders need to navigate ahead of IPO day.

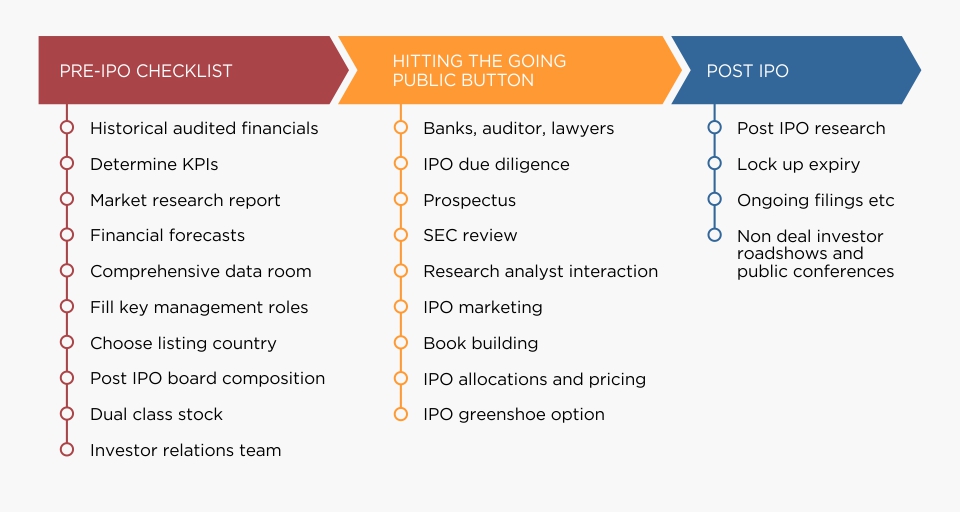

Pre-IPO checklist : 12-18 months prior to launch

This can vary but a rough house prep work would include:

- Financials: Preparation of audited financials, including segmental financials if applicable (typically three years of audited financials) under the appropriate accounting standards and appropriate GAAP based on the listing exchange). Ideally, the same auditor should cover all the entities in the group or it can create significant timing issues.

- Determining key business KPIs or drivers and establishing an internal process or system to get these signed off by auditors or an independent third party.

- Implementing an ERP system for speed and accuracy of getting the financial / business picture.

- Engaging a market research organization to help with an industry study covering size of, and growth of target addressable market, competitive landscape, company market share (if possible), for disclosure in the IPO documents.

- Filling key management roles e.g. a CFO role is critical and ideally filled at least six months prior to public filing.

- Preparing financial forecasts and ensuring the ability to meet/beat those forecasts.

- Establishing a data room (including material business contracts, material loans, litigation papers, ESOP plans, company presentation, MIS, historical financial MIS etc).

- Deciding which country to list in as lots of preparatory steps are linked to this choice.

- Planning your post-IPO Board composition (independent directors, sub committees, etc).

- Discussion amongst the founders and the board on dual class stock (for differential voting rights for founders) if planned.

- Designating or hiring an investor relations person who can interface as a single point of contact between the company and a myriad of investors on ongoing business.

- Start building up a public markets profile – i.e. through participation in select investor conferences and roadshows organized regularly by most major investment banks.

- Consider hiring a PR firm to raise the company’s profile with the public (more relevant for non-US listings; the US has strict gun-jumping rules with regards to IPO publicity).

- Consider putting a press policy in place with only a few designated people allowed to interact with the media.

- Consider hiring an audit firm for internal audit; this is different from your statutory auditor.

Hitting the “Going Public” button: 6-7 months prior to launch

- Hiring Specialist Advisors: Hire a capital markets law firm (known as company counsel), hire banks (also known as underwriters), engage an audit firm. The banks will hire their own legal counsel, referred to as an underwriters’ counsel.

Side Note: The expense clock starts now. Lawyers and auditors mainly work on a fixed basis (and get paid regardless of outcome); banks accept work on a contingent basis (success fee only, though they may also ask for reimbursement of out-of-pocket expenses incurred on the deal). - IPO Due Diligence: Underwriters, legal firms and auditors will conduct due diligence across key areas relating to business, legal and financial aspects. It is their responsibility under law to conduct diligence covering all material aspects that would be relevant information for a prospective investor. In some ways, they are standing in for investors who will not have access to this level of in-depth due diligence.

Side note: Well begun is half-done. A thorough data room is a massive productivity hack. The CFO is typically overall-in-charge of the IPO process. - Prospectus: The outcome of this exercise is a prospectus that is supposed to capture the key information that is relevant to an investment decision, relating to purchasing your shares in the IPO. Incorrect information or omission of material information are both bad and lead to liability for the company, its senior management and its directors.

Side Note 1: The prospectus is both a marketing document, as well as a risk disclosure document. The company and underwriters therefore have to achieve the right balance of highlighting all the attractive points of the business, but also what could go wrong. - Contents of a typical US IPO prospectus are: Prospectus summary, risk factors, market and industry summary, use of proceeds, dividend policy, capitalization and dilution, summary financial and operating data (and management discussion of this data), business details, company management, key shareholders and selling shareholders, underwriters, legal matters, full form consolidated financial statements and material contracts (i.e. a contract with a major customer, with sensitive information redacted.)

Side note: The format of the prospectus is prescribed and regulated by capital markets regulators – i.e. SEBI in India, SEC in the US, etc. The disclosure standards vary from a retail investor centric stock market like India, from the institutional investor centric stock markets like the US. As a result, the prospectus format also differs, which may require additional work and information inclusion.

- Securities Regulator review: Once the company has its prospectus drafted, it will submit it for review to the relevant securities regulator. For US IPOs, SEC staff will read it and propose deletions, inclusions, have questions on certain disclosures, and their accounting staff will review key accounting policies, such as revenue recognition and expense capitalization for consistency with accounting standards, as well as comparability with other companies in the industry. The US IPO process allows confidentiality until closer to the roadshows.The SEBI review process, while quite similar to an SEC review, is based on a prescribed form with a legal requirement for back-ups for the information submitted. There is also greater attention on risk factors and presentation of only audited financial data. The draft prospectus submitted to SEBI is made available publicly on its website. Be prepared for poison-pen letters that people may employ to hold up an IPO.

- Research Analyst Interaction: The IPO underwriters have equities teams that include both research analysts and equity sales teams. The relevant research analyst for your company’s sector/country will interact with the company mgmt. They will build their own understanding of the company’s business, industry, growth prospects, forecasts. Once the IPO marketing starts, research analysts brief the equity sales teams and also directly share their views with prospective investors.In context of an India IPO, research analysts do not prepare forecasts, but their understanding of the business and growth drivers is helpful in engaging with investors to provide an additional comfort. For a US IPO, the research analyst models are primarily used for internal sales team education.

- IPO Marketing: Once the regulator greenlights the prospectus, the banks determine the target investors, size, pricing and primary-secondary composition of the IPO offering in consultation with the company. A typical IPO size is 10-20% of the company’s market cap at listing, though there are many exceptions.E.g. the final IPO metrics might look like: Company X will sell 40mn shares (30m primary, 10m secondary shares) at a price range of $12-$14 per share, for an IPO size of $480M-$560M. Total shares outstanding after the IPO are 200m, resulting in an IPO market cap of $2.4B-$2.8B and 20% of the company’s shares sold in the IPO.

- Book building: During the IPO marketing period, the order books are open. The underwriting banks are receiving orders from investors, this includes how many shares they want, and at what price. Hot IPOs often have heavily inflated orders and no price limits.In the case of an Indian IPO, in practice, shadow book-building occurs prior to the actual launch of an IPO with price range, in the form of a shadow investor demand analysis which provides the issuers and selling shareholder(s) with insights into a demand curve before the price range is finalized and the IPO is formally launched.

- IPO Allocations and pricing: Let’s say the IPO marketing has gone well. There’s a lot of demand and 100 institutional investors want to be allocated shares in the IPO. In US IPOs, company management will sit down with the underwriters on the final day after the order book has closed, to go through this book and decide on key allocations. They will price the IPO such that all of the shares (e.g. 40M shares) are sold in the IPO. All investors whose orders were below the IPO price get nothing.

Side note: Long-only investors perceived to be stable shareholders (such as Blackrock Capital Group, Fidelity, MFS, Wellington) are preferred in the IPO allocations. Hedge funds (or funds that go both long and short stocks) are perceived to be of ‘trader mentality’ and put on a lower perch. The reality though is mixed, and many hedge funds are actually very knowledgeable and stable holders.

- IPO Greenshoe option: After the investor allocation decisions, the underwriters will communicate the allocations and pricing to the investor accounts. The investors from here on are on the hook to remit the funds to the underwriters. If they default, the IPO banks are on the hook to remit the proceeds to the company and hence the origin of the term “underwriters”.The final prospectus is filed, which captures the final information on shares sold, pricing, etc.

Post IPO

- Post IPO research, Lock up expiry: 40 days after the IPO, the IPO banks’ research analysts are allowed to release their research. No research can be published by the IPO banks until this point.

Pre-IPO shares are restricted from being sold. This is known as an IPO lock-up. These are to prevent excess supply of shares from coming into the market until the stock has “seasoned”. Typical US IPO lock ups are six months from IPO date. Lock ups cover ~96-97% of stock outstanding. In US IPOs, lockups are contractually required by underwriters. In India, IPO lock up is one year for all pre-IPO shareholders and the Founders have a longer three-year lock for 20% of the Company’s share capital owned by them. The regulator’s objective here us is to align the interests of the Founders with the public

market investors. - Ongoing filings and disclosures of material events: As public companies, the Company now has ongoing reporting obligations regarding material developments, as well as regularly file its quarterly and annual results. After each quarter, the Co will make its filing and hold an investor call to discuss its financial and operating results. Investors and analysts get to ask questions of the management team. The disclosures are made via public filings so as to be available to all investors simultaneously. Selective disclosure is an generally an offence under securities law .

All shareholders holding 5% or more shares post IPO will need to publicly report their shareholdings and update changes.

Side note: The Company’s legal counsel and its CFO will take over this maintenance filings at this point.

A Summary Checklist

To read about listing in India vs the US, click here.