Financing education: our partnerships with Leap and Eduvanz

We think the student financing market in India needs a new approach. The thesis is simple: underwrite a student on their future and not their financial past.

Ashish Agrawal

Published August 14, 2020

Education is the engine of economic mobility. A good education enables kids born without privilege to get a shot at the same life as those born in privilege. Covid-19 has brought education to the forefront of popular discourse with school and colleges shut and ed-tech enabling a larger share of learning.

Sequoia India has been investing in the education sector for over a decade and has partnered with companies such as Unacademy, Eruditus, K12 technoservices, Cuemath, Doubtnut, Scaler Academy and Classplus amongst others. These companies have leveraged technology to significantly reduce the cost of quality education, making it more accessible and affordable to a wider number of students. Unacademy’s ‘all you can eat’ subscription for IIT-JEE, for instance, costs a fifth of traditional alternatives.

While these companies are playing their part in democratizing access to education, many segments of education are still expensive and out of reach for many students. In developed countries, cheap credit is widely available to students who need help with tuition fees. But in developing markets like India, student loans are still scarce and expensive. Banks and financial institutions in India underwrite education credit in the same manner as they underwrite personal loans, i.e. by assessing the past income and financial profile of borrowers (or their parents). Hence, many students (and their parents) fail to prove creditworthy and are either unable to get access to the education they aspire to, or have to take on more expensive loans, sometimes even pledging their parental homes as collateral. This can be soul-crushing for a young student who has had to work incredibly hard to even get access to quality education in India’s supply constrained market.

We think the student financing market in India needs a new approach. The thesis is simple — underwrite a student on their future and not their financial past. Students who have shown the grit and discipline to qualify for quality education that will help them land a solid job, should be given credit based on their future employability. We are excited to partner with two fintech companies in recent Series A rounds — Eduvanz and Leap Finance — who are bringing much-needed innovation to education financing.

Eduvanz plays in the domestic education market and provides 0% interest rate loans to students pursuing upskilling (i.e. digital marketing, analytics, programming) and skilling (i.e. personal trainers, beauty professionals) courses. Eduvanz is a platform where, on the assets side, it partners with course providers and enables a higher fraction of their applicants to be able to afford the courses. In return, the course providers bear the interest expenses for the loans. The students, in most cases, pay no interest. On the liabilities side, Eduvanz partners with a diversified set of large lenders enabling them to take exposure to education loans.

Leap, meanwhile, finances Indian students pursuing graduate studies abroad with affordable zero-collateral international currency denominated loans. A dollar denominated loan is often cheaper and more convenient for an Indian student graduating with a Master’s degree in the US since he/she is likely to earn in that currency. Leap Finance also acts as a platform that partners with large institutional lenders in destination countries to whom it offers superior risk adjusted yield.

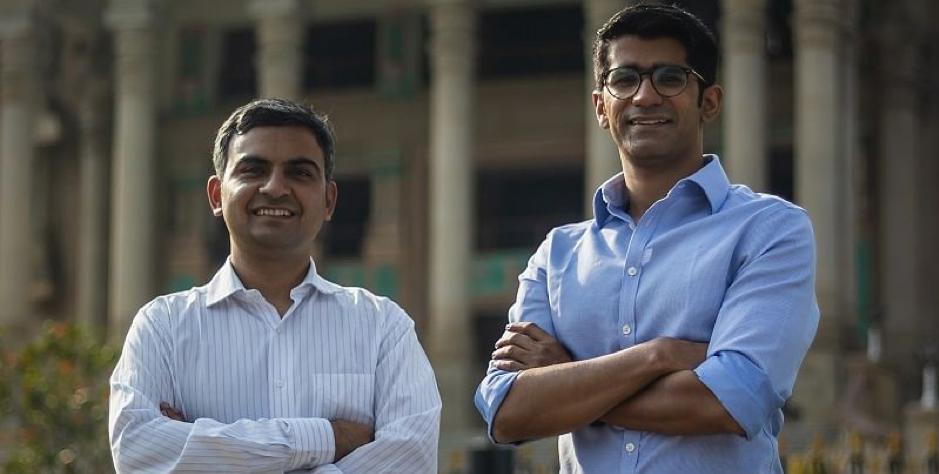

Like many Sequoia India entrepreneurs, the Eduvanz and Leap founders started their companies armed with both experience and deep insight into the problems of their target industries. Leap was founded by Vaibhav Singh, who worked at Deutsche Bank, Capital Float and Incred, and Arnav Kumar, an investor-turned-founder who forayed into EdTech after starting a consumer internet startup in the used-car space. Eduvanz was cofounded by Varun Chopra, who spent many years at Nomura India and Raheel Shah, who had previously set up several EdTech companies. Both co-founding teams possess a strong foundation in financial services and an experience of building consumer facing businesses.

Underwriting student loans based on employability requires significant understanding of the education landscape, including a calibration of a specific student’s academic performance and broader placement trends. In both cases, the founding teams have drawn on their respective backgrounds to come up with a student friendly yet extremely high credit quality lending operation.

Indian students today spend >$100B on education domestically. There are almost 40M students pursuing higher education in India but less than 5% students of them are able to avail any credit to finance it. Similarly, students from emerging markets studying outside their countries spend $150B annually. Indian students are the second largest contributors, after Chinese students, spending $15B annually. Again, credit penetration in the study abroad segment is miniscule; only $1B of the $15B Indians spend on overseas tuition is funded by student loans. Both domestic and international education markets are massive with limited credit penetration.

During downturns, such as the one expected post Covid-19, education becomes even more critical as workers facing potential unemployment take the opportunity to upskill themselves, often enrolling in higher education. By improving access to credit, we hope Leap Finance and Eduvanz will not only build large businesses for themselves but also fuel the aspirations of millions of students to have a shot at a better life