Blockchain Applications That Make Sense Right Now

Here’s our take on which blockchain technology applications are most likely to drive mass adoption, and categories that may not be the best fit – at least at this point in time.

Shailesh Lakhani, Kriti Gupta, Shivam Kumar, Augustus Ilag and Pranav Shivram

Published July 29, 2022

The future of blockchains, and the best use cases for this emerging technology, have fast become a polarizing topic.

Evangelists feel blockchains have the potential to disrupt business models and fix the security, ownership and data privacy problems that have plagued the Web2 world. Some skeptics don’t believe blockchain has any practical use, beyond speculation. For others, it’s technology looking for a problem to solve. There are large personalities, big bucks and a lot of hot air on both sides of the debate.

In the last two years the team at Sequoia India & Southeast Asia has partnered with more than two dozen Web3 companies, and dove into the wonderful content that this industry publishes (crypto Twitter is addictive…). Here’s our take on which blockchain technology applications are most likely to drive mass adoption, and categories that may not be the best fit – at least at this point in time.

Data, distribution and ownership

To start, let’s step back and look at some first principles. Digital content/assets of all types, whether it be software applications, files, code or media, can be infinitely copied online. Piracy has been an issue since the dawn of the Internet. It quickly becomes impossible for the owner to trace this, never mind insist on attribution, limit its use or benefit from the downstream value creation. Copyright laws, digital rights managements, paywalls and hosted solutions are ways in which companies try to control the distribution and usage of software and data. There are obviously limitations. Despite media paywalls, for example, there are Telegram groups for most topics where one can find just about everything for free.

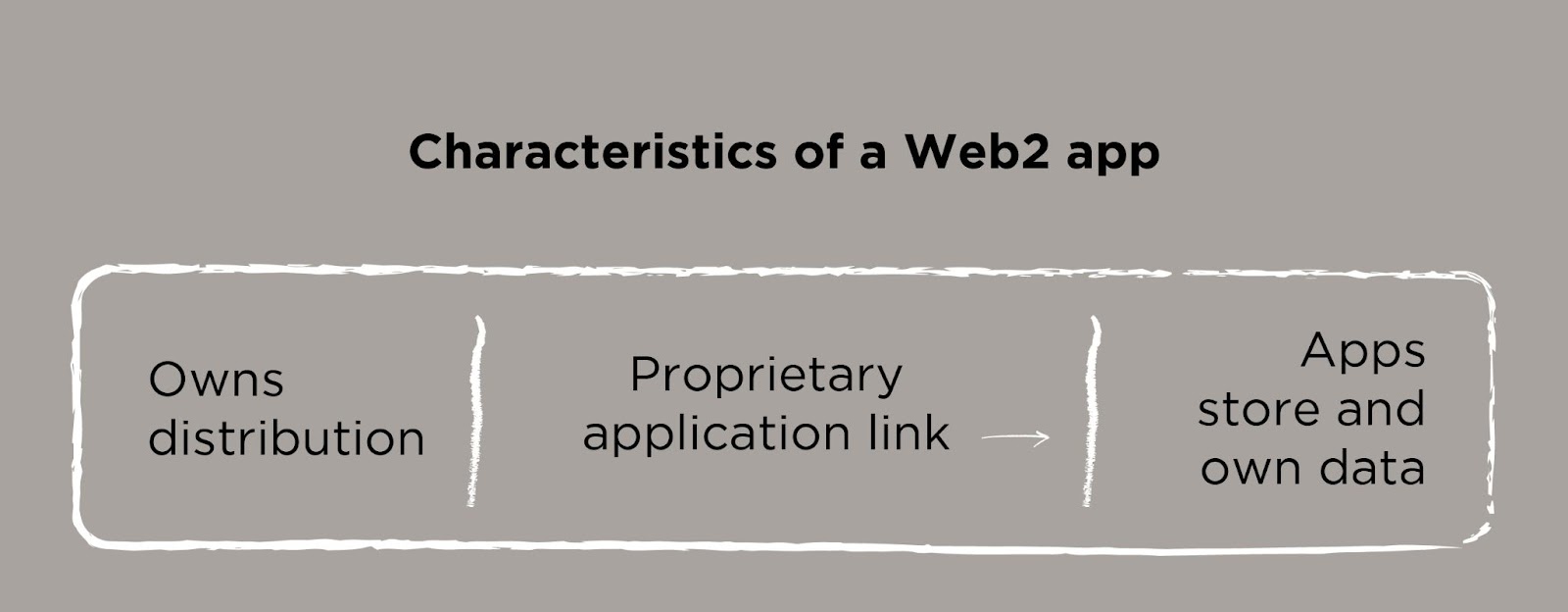

Many Web2 companies embraced this reality and built applications that were intended to be distributed as widely as possible. The rise of smartphones and affordable broadband – as well as cloud services that reduced storage costs – over the last two decades paved the way for this distribution-first freemium model. The advent of social media, meanwhile, turned users into creators on free platforms that offered to connect them with their friends, or the world, in exchange for their data, a scarce resource that quickly became ‘the new oil’. When consumers decide they no longer want to pay that price, the ownership of their data and digital identity become the price they pay.

Users can’t move their content across platforms, because they technically don’t own any of it; in the digital world of Web 2 all users operate in a rental economy, and true ownership is pretty much nonexistent.

Enter blockchains

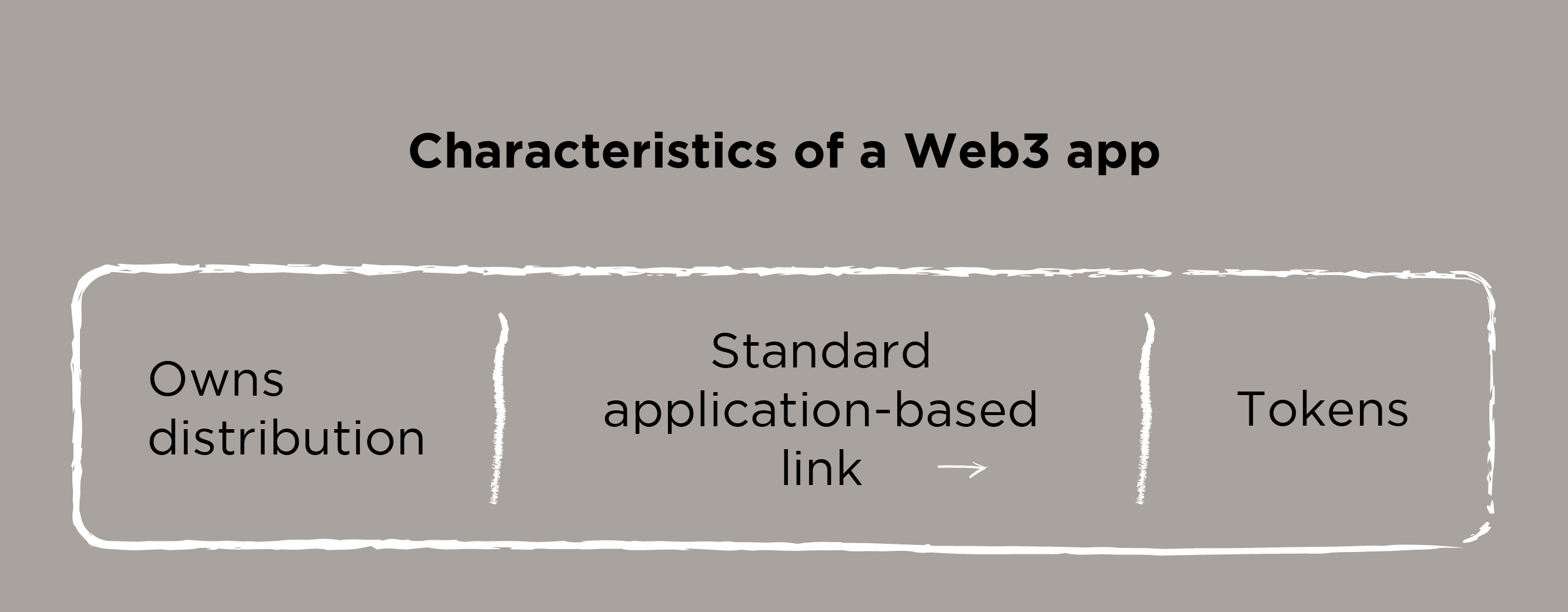

Using blockchain technology, users can create digital assets that are verifiable, scarce and portable – the core properties of a “token”. The owner of a blockchain-generated token can be sure they are the only owner of a limited quantity item.

These are tokens that have genuine value as they solve the ownership challenge digital assets have had since day one. This is the core building block that is not possible in Web2’s centralized world. Yes, Fortnite can sell you virtual clothing, and a bank can show a deposit in your account, but those assets are at the behest of the central actors. Creators are similarly beholden to the platforms that distribute their products, and their popularity is governed by their algorithms and business interests of those centralized platforms.

With blockchain, new types of assets can be created that hold value outside any centralized platform (even though those platforms may still be very relevant for creation, display and distribution). No centralized actor can unilaterally change the ownership of an asset ‘on-chain’, and rules are visible in public code. Ownership can be ascertained with certainty for all who examine it. A picture, a ticket, a membership card can now be on-chain and be truly “owned” by the user vs the issuing entity. Suddenly, digital property rights are possible, and imbued with the aforementioned benefits of verifiability, scarcity, and portability.

Over time, we expect more users will demand assets that are created on blockchains. So let’s explore the use cases of applications that verifiable, digitally scarce portable assets allow. In doing so we will look at a few different aspects of applications. 1) Who is the issuer of these digital assets? What gives them the right to do so? 2) What is the user expectation of this asset? Is it to make money? 3) Why was this not possible before blockchain – or what makes it better with blockchains? 4) What remains to be done to make this much bigger?

Here are a number of use cases that will drive mass adoption. (This is not an exhaustive list by any means, and a lot of early use cases that touch money more closely are not covered.)

Type: Bitcoin

- Use Case: Store of value

- Issuer: Satoshi Nakamoto – creator of Bitcoin

- User expectations: Stable store of value, appreciation

- Blockchain advantage: Vs. gold, its leading competitor in the alternative asset category, bitcoin is easier to transfer. Vs. the Dollar, its supply is limited and controlled algorithmically.

- Other: Bitcoin requires belief from the user, as the string of bits has no real world value despite the gobs of electricity used to generate it. Bitcoin at least has crossed part of the chasm on this. Unfortunately, it is still volatile, in part due to leverage being used and the fact that widespread belief is not quite there.

- Work to be done: Energy consumption is still a huge issue here, as are transaction costs, but efforts like the Lightning Network, a Layer 2 solution that allows for faster payments in bitcoin, are beginning to show some benefits. Regulation, enabling central banks to hold bitcoin and clarity on how taxation works around the world will help.

Type: Stablecoin

- Use Case: Digital money, payments

- Issuer examples: Circle, Tether. Issuer needs to be audited to ensure they are collateralised on par with their issuance.

- User expectation: Stable store of value, alternative currency

- Blockchain advantage: Vs. a bank deposit, lower cost to transfer allowing easy access to USD deposits as compared to most banks worldwide (USDC trades at 5% premium in India for example). Can be programmed. Can’t be revoked (at least under the lack of regulation today). Supply is verifiable. Settlement time can happen in seconds vs days.

- Other: The rails to transmit stable coins are cheaper than the rails to transmit fiat (though onramp/offramp are often still expensive). Remittances via stablecoins have significant potential and are an underexploited application. Lending systems on stables are significant. Regulation though will have a bearing both on stablecoin issuance and capital controls.

- Work to be done: Transparency of stable coin issuers, regulation.

Type: Profile picture NFTs

- Issuer: Artists (Eg. A experimentive entity like Larva Labs, or a community creator like Yuga Labs)

- User Expectation: Status/Flex for the user, community membership, value appreciation, IP ownership

- Blockchain advantage: Portability across platforms while being truly unique to you, ownership can’t be revoked or duplicated, supply is verifiable, programmable royalties

- Other: We think this expression will see significant growth when the ability to display across Instagram and other large Web2 platforms ships. Showing status, joining communities and being part of clubs are core human needs

- Work to be done: Not a lot, and yet a ton – the base use case works today, and there will be much innovation in the future.

Type: Digital Art

- Issuer: Artists

- Expectations of the holder: Art ownership, asset appreciation

- Blockchain advantage: Ownership can’t be revoked or transferred, supply is verifiable and limited (provenance)

- Other: Like other art forms, curators and the art establishment will play a role in creating heros. And while there will be a lot of junk created with no value, this generation’s Picassos, Van Goghs and Rembrandts will also emerge here.

- Work to be done: Not a lot

Type: Artist (or company) loyalty programs

- Issuer: Creator, corporates

- User Expectation: Proximity to a creator (multiple levels of fandom), appreciation

- Blockchain advantage: Resale digital assurance (can buy it from original owner and be sure its unique and usable), verifiable publicly (can show on Instagram you are a real fan), programmable (original owner could take a cut of resale revenue)

- Other: The rise of platforms like Patreon and Onlyfans show that there is a market need for creators to connect directly with fans, with a financial relationship. Unfortunately, on these current platforms, that relationship is opaque to fans. Fans don’t know if they’re part of a niche fan group with access to the creator – ie whether they’re part of a top 10 or top 100 fans super group – nor can they share in the increased popularity of the creator. This could be a great way of creators financing themselves in their early days.

- Work to be done: Early stages of being built.

Type: Digital Receipts/Rights

(eg. Uniswap Liquidity provision derivative tokens, Lido staking tokens, Ribbon vault deposits)

- Issuer: Digital Marketplace/Merchant

- User Expectation: Share of an asset, proof of contribution

- Blockchain advantage: Ensures that your ownership is proportionate to your contribution in a pooled asset

- Other: A digital receipt of a contribution can be used recursively as further collateral (composability) with a rewards loop

- Work to be done: Works great.

Type: Private Sector Data

- Issuer: Private organisations

- User Expectation: Transparency and ease of access of data

- Blockchain advantage: Data can be traced back to the source efficiently, and without data brokers gatekeeping meaningful and accurate data

Other: Such traceability and efficiency allows easy monetisation of data

Work to be done: Need a huge nudge for enterprises to move their data on-chain.

Type: Tickets to events

- Issuer: Event companies

- User Expectation: Event entry, potential for resale, social proof

- Blockchain advantage: Resale digital assurance (can buy the ticket from original owner and be sure its unique and usable), verifiable attendance publicly (can show on Instagram etc you are really going or went), programmable (issuer could take a cut of resale revenue)

- Other: This class of applications has a lot of potential, and as event companies start building on these lines. there should be deep user demand.

- Work to be done: Early stages of being built

And while there are many more use cases, there are also a few sectors where we are not sure if blockchains provide an upper hand.

- Applications that don’t fit as verifiable digital scarce goods include real estate or physical asset linked tokens. If you still need the rule of law to enforce the token ownership, then a centralized actor like a country, city or nation will effectively dictate terms. So, both the ownership and enforcement can’t be ensured on chain.

- Regulations will play an important role in equity or funding or airdrops of tokens. The tests the SEC uses to define equity would make tokens subject to securities laws for the majority of current tokens. That is a major limiting factor in tokens being used as a replacement of equity, which begs the question if tokens are always the right use case? Also, it’s early to say that giving tokens to users as incentives is leading to a long term shift in behavior.

- Using tokens as proxies for income streams or to raise startup funding may be an even worse use case. When startups issue tokens to buyers who expect income along with appreciation and a certain level of governance, issues can easily arise due to regulations. It’s very hard to get to product-market fit as any early-stage, and being ‘public’ too early with many stakeholders makes it harder to take tough decisions. Early liquidity can actually prove a distraction, making it hard for founders and employees alike to stay focused – particularly if there’s incentives to sell early on.

What’s more, most users are not keen, or qualified, to participate in governance discussions. While this may seem like a promising use case to crypto founders, there’s a lot that needs to change before tokens are as good as traditional equity.

Over time, we expect tokens to turn up many more use cases as regulation evolves, standards emerge, blockchains mature, and as entrepreneurs explore this design space further. In particular, there still remains much to be done to make token based applications far more usable by normies. Usability, right now, is a huge issue. To be an active participant in the crypto community right now means joining numerous Telegram/Discord groups, keeping up with the current memes on crypto Twitter, knowing the trustworthy personalities, using a private key and paying super high gas fees. In a world of ‘swipe to book/buy/date’, the usability of crypto is barely a 1/10. We believe companies that focus on usability while bringing blockchain technology to the masses will be wonderful investments in the years to come.

Despite a turbulent first half of the year, we remain as excited as ever to see new applications that give users back control over what’s rightfully theirs. While early examples of blockchain use cases like PFP or art NFTs may seem small, they are important building blocks to show us what user control of data looks like.

Web3 has, over the last few years, onboarded some of the most creative and technically sound folks on the Internet, and we can’t wait to be early users of what is being built today, and if chosen, become partners in many as well.